For any Insurance Company in the world, processing claims is one of the many business-critical and time consuming functions. Enhancing Customer Experience, reducing cost of claims by improving operational efficiency, and better loss ratios are some of the key industry drivers for claims optimization. Various InsureTech companies are changing the way claims processes are managed today. Customer-centric smart solutions from claims intake to final payment, are helping insurers improve their productivity, cut loss adjustment expenses, reduce overall TAT for claims settlement, thus improving customer satisfaction.

Claims cost almost 80% of the premium income. By increasing claims processing efficiency, insurer can reduce their loss adjustment expenses, and significantly improve customer satisfaction. Reducing the claims cost by 1% will have significant impact on overall cost savings. Hence, there is a need for an integrated solution to optimally manage claims operational cost and improve customer experience. The solution must overcome the challenges of manual, multipoint and inconsistent processes, fraudulent claims, and lack of integration with core systems, to improve productivity.

Digital disruption is fuelled by the adoption of artificial intelligence, particularly in insurance claims management. AI can enable insurers to use rich historical data and algorithms to improve future predictions. With the help of machine learning and deep learning, AI gains ability to learn from past experiences, detect patterns, relationships, anomalies, which help AI to take informed decisions like a human. With an advantage of visualizing and advance interaction capability, AI is helping insurers to enrich customer experience to the core.

Thus, insurance carriers can greatly benefit from the recent advances in artificial intelligence and machine learning. A lot of approaches have proven to be successful in solving problems of great interest such as pricing, claim handling, and fraud detection among others.

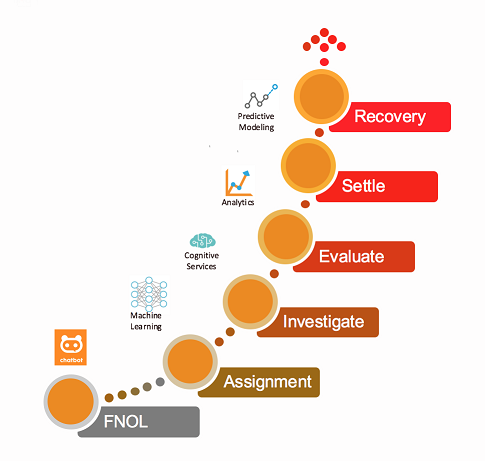

Claims operations can be improved using AI in various ways. There are around 2000 start-ups focusing on Artificial Intelligence as core focus area. It is interesting to see AI implementations in the Insurance Industry, where predictive powers of AI is all set to replace key roles in the insurance value chain such as actuaries, surveyors, adjusters to reduce labor costs, and obtain more accurate predictions. On the other side, driverless cars are a treat to auto insurance premiums. Insurance claims processing is also undergoing transformation in a complete value chain from FNOL to Final claim settlement.

AI technology adoption will help insurers improve customer experience by implementing AI bots to have seamless interactions to accept claims (FNOL), and inquire about existing claims and answering FAQs. This will improve customer experience and reduce workload on call center/customer executives.

Lemonade is a licensed insurance carrier offering insurance to renters and homeowners, exclusively through a chatbot app for smartphones. It takes about 90 seconds to get insured and about 3 minutes for claims to be paid.

- Machine learning and Deep learning will help claims triage (Assignment) accurately to the most suitable adjuster, which will help improve TAT and reduce expenses of reassignment.

- Machine Vision and Image Recognition will help implement self-service claims inspection by the claimant. It will reduce adjuster visits to repair workshops.Germany-based Motionscloud offers a mobile solution for the claims handling process, including evidence collection and storage in various data formats, customer interaction and automatic cost estimation.

- Early detection of fraud using deep learning and predictive analytics will help insurer fight fraud with more ancillary and improve investigation process.Premonition is US-based company, which offers an Artificial Intelligence system that mines Big Data to find out which Attorneys win before which Judges. This helps insurance companies to assign litigation claims to the right attorney and increase probability of winning.Paris startup Shift Technology developed an AI-powered cyber security solution to detect fraud in the insurance industry, using big data and machine learning algorithms.California-based startup Captricity has developed machine learning algorithms that can extract and transform data from handwritten and typed forms at a +99.9% accuracy. This reduces data entry efforts and help text analytics.

- AI:based estimation using machine vision and deep learning is taking pace, which helps automate estimation process and gives response instantaneously.Tractable is a London-based artificial intelligence corporation that promotes its ability to streamline automobile, property damage repair payments by comparing uploaded photographs and repair estimates, reducing the cycle time from days and weeks to minutes, without involving a human claims handler.UK-based startup RightIndem looks to put the injured party in charge of the entire claims process for motor vehicle collisions by inviting customers to make and process claims at "their pace", using their smart phone, tablet, or personal computer.

- Claims payments are expedited by settling claims, using various technology enablers and reducing overall TAT for claims.Zürich Insurance announced that it deployed artificial intelligence to evaluate personal injury claims after testing showed claims processing could take years’ worth of information, and reduce it to a single decision in a matter of seconds. Insurance companies in Japan and Great Britain have begun doing the same, replacing staff members with sophisticated computer algorithms to perform the work previously done by humans.

The one constant among all of these companies is the promise to reduce claims “leakage,” a term used to describe the dollars lost through claims management “inefficiencies” that raise costs and lower profits for insurance companies.

Conclusion

At its core, the insurance industry exists to reduce (or make restitution for) risk and harm. Digital technologies enable us to identify, prevent and respond to risk and harm, in more efficient and smarter ways. By utilizing AI capabilities complementing each other in each phase of a claims cycle, an Insurer can achieve improved services, increased productivity and enriched customer experience. Claims department can empower their workforce to focus on valuable services to the customers, and take advantage of AI technologies to improve their regular tasks.